41 sales tax and tip worksheet

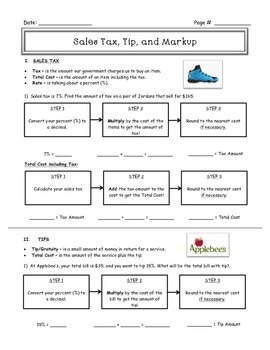

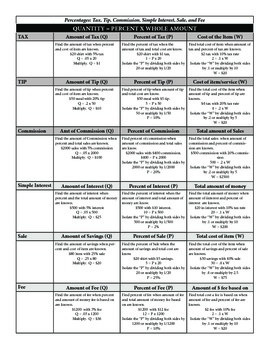

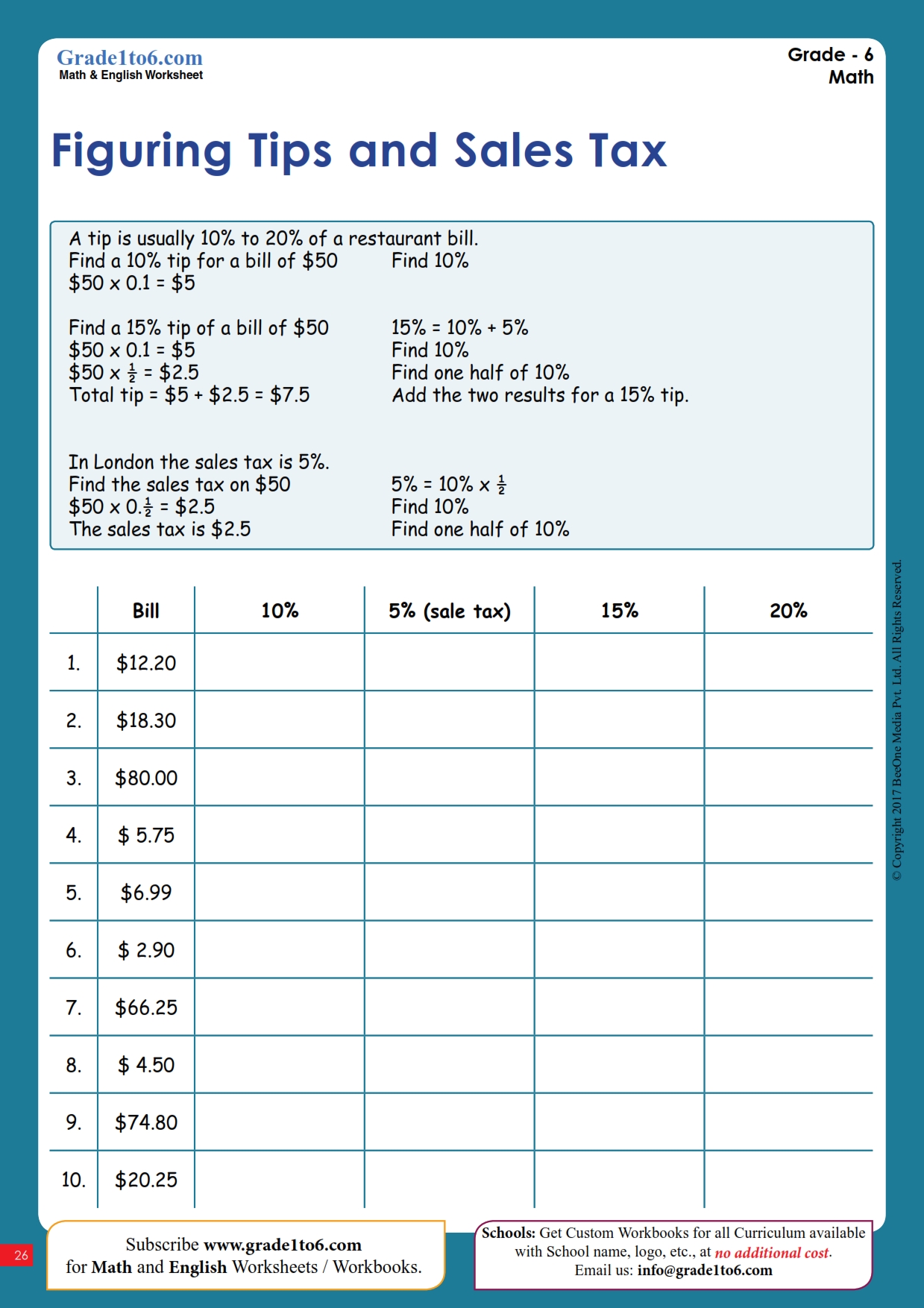

Sales Tax and Tip Lesson Plans & Worksheets Reviewed by Teachers Taxes, Tips, and Salaries. For Students 7th - 9th. In this taxes, tips and salaries worksheet, students read story problems and determine the sales price, percent of change, amount of tax, and final price. This four-page worksheet contains 8 multi-step prolems. PDF Name Period Date Tax, Tip, and Discount Word Problems - WPMU DEV 9. Mrs. Smith paid $125 to have her hair colored and cut. If she tips her hairdresser 15% of her bill, how much was the tip? , 10. PA. Sales tax is charged at the rate of 6%. Find the tax and the total price you would pay for an $860 stereo. ,

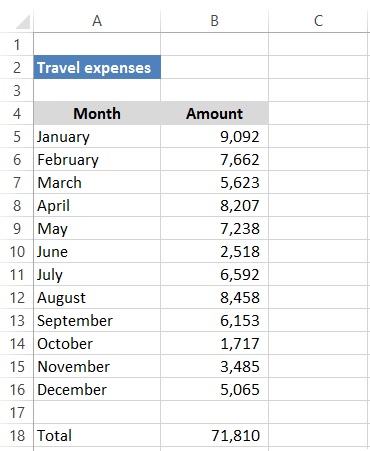

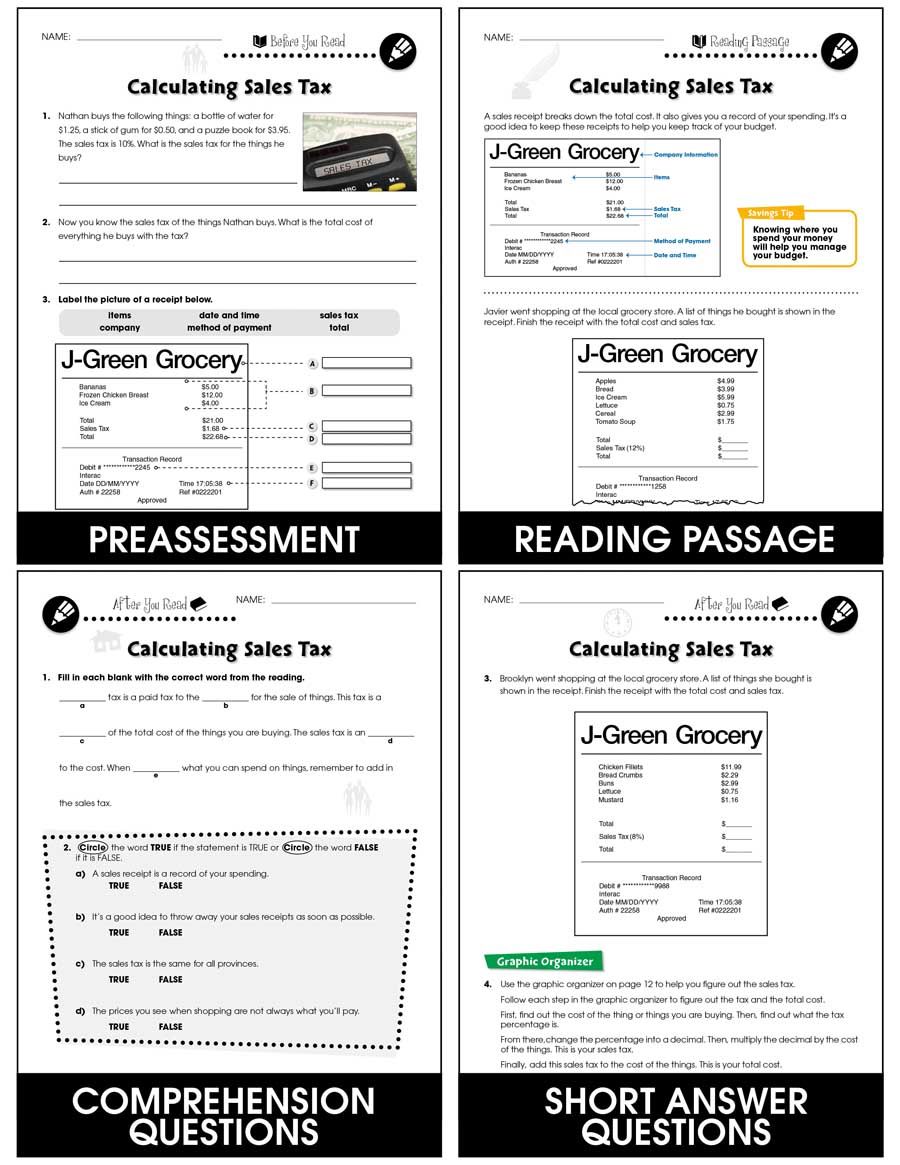

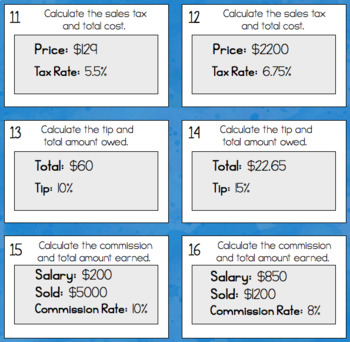

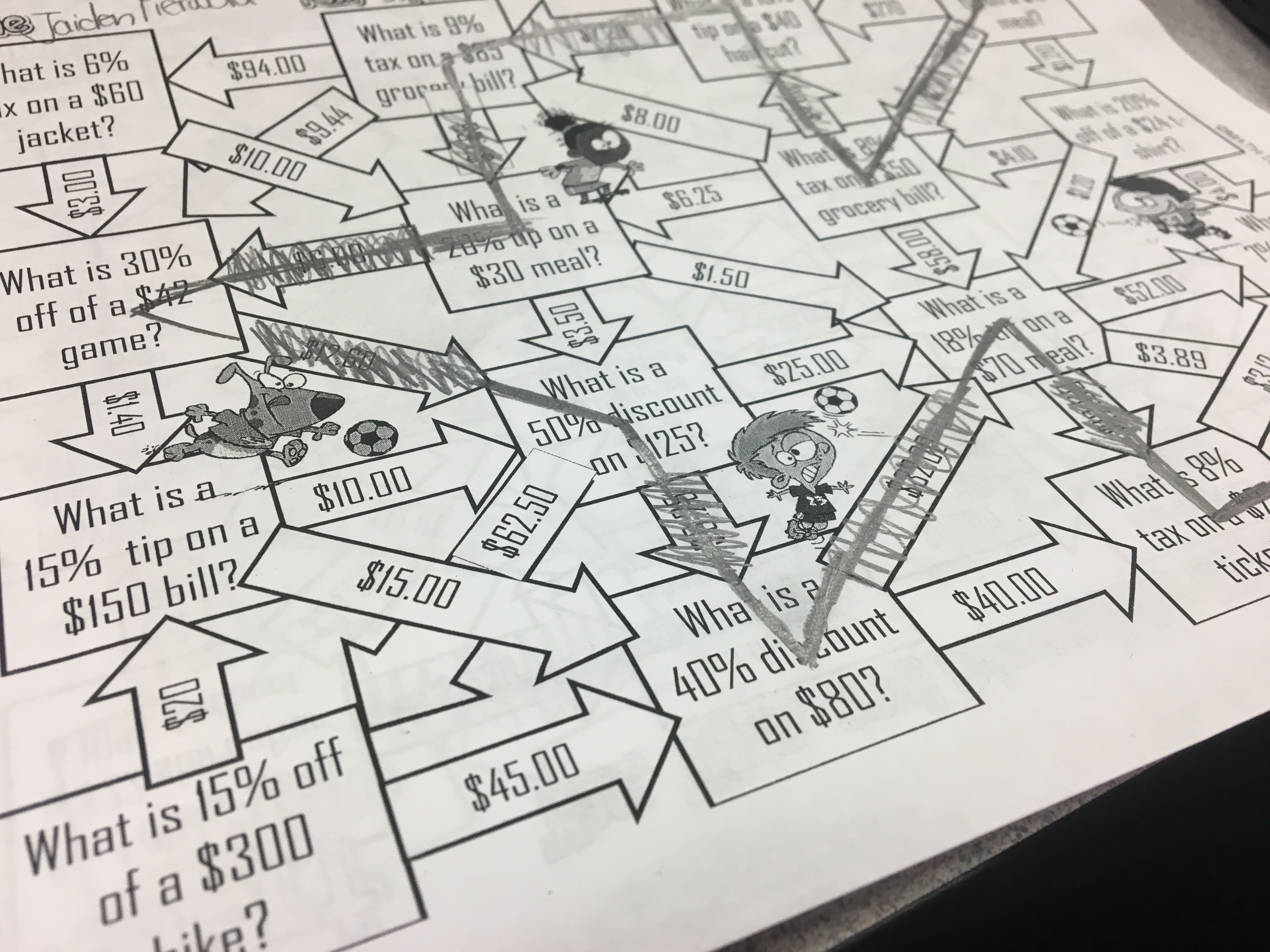

Sales Tax, Tips, Commissions Teaching Resources | TpT - TeachersPayTeachers These ready to print worksheets are a great way to review finding sale tax, tip, and commission. Each topic consists of 6 printable worksheets featuring finding the sales tax on purchases on sales receipts, finding sales tax with mini menus, and mazes that make solving problems a little more fun. Finding the tip has word problems as well as mazes.

Sales tax and tip worksheet

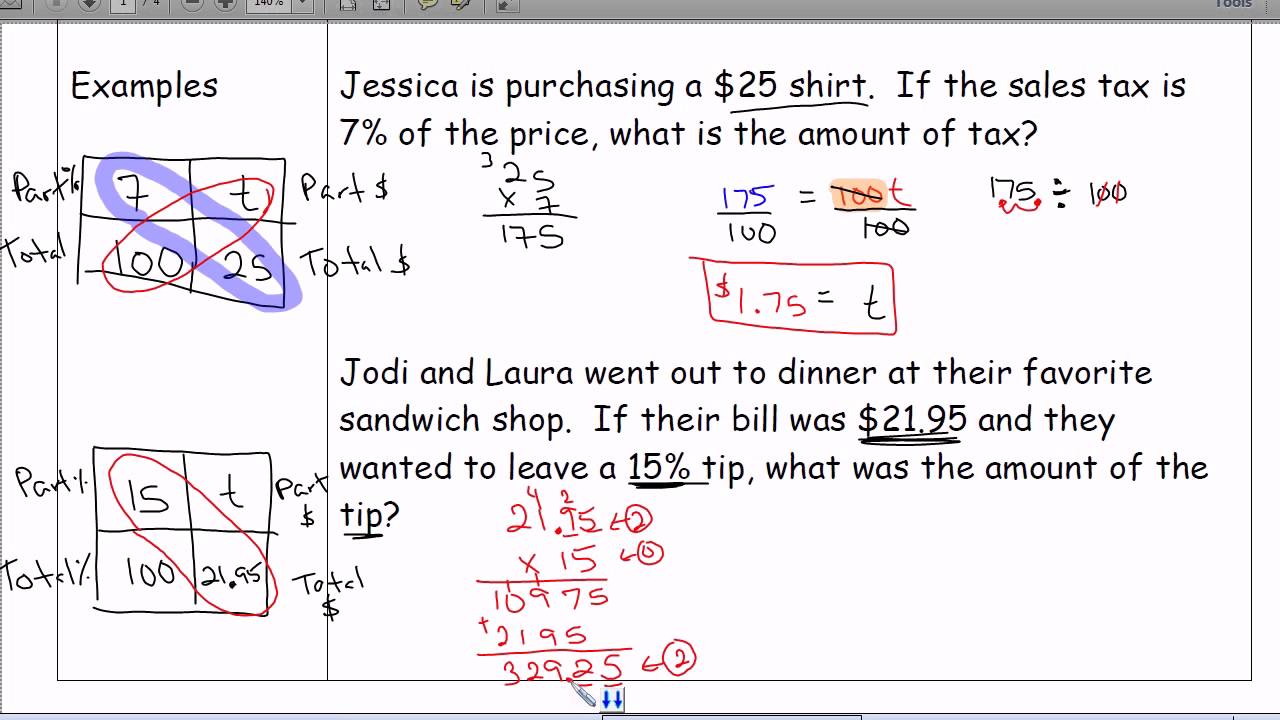

PDF Tax and Tip (Percent) Word Problems - hansenmath.com 1. A bicycle is on sale for $189.50. The sales tax rate is 5%. What is the total price? 2. Rosa and her friends are eating out for dinner. The bill was $45.80. They want to leave a 20% tip. How much should they leave for tip? 3. Rick bought 3 shirts for $18 each, 2 pair of socks for $3.99 a pair, and a pair of slacks for $45.00. SALES TAX DISCOUNT AND TIP WORKSHEET - onlinemath4all Estimate the tax on shoes that cost $68.50 when the sales tax rate is 8.25%. Problem 3 : The dinner check for Mr. David's family is $70. If a tip of 15% is paid, How much total money should Mr. David pay ? Problem 4 : If the sales tax rate is 6%, find price of the shirt after sales tax on a shirt that costs $30. Problem 5 : PDF Sales Tax and Discount Worksheet - Loudoun County Public Schools MORE COMPLICATED QUESTIONS!!! , 8) At best buy they have a 42" TV that sells for $1250 and is on sale for 15% and sales tax is 6.5%. What is the final cost? , 9) If your cell phone bill was $67.82 and there was a 7.5% late fee, how much was the charge for the cell phone bill? ,

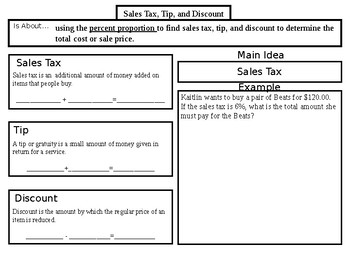

Sales tax and tip worksheet. PDF Sales Tax Practice Worksheet - MATH IN DEMAND Sales Tax = $75.25 x 0.08 Sales Tax = $6.02 If a board game costs $28 and the sales tax is 5.75%, what is the sales tax? Sales Tax = $25 x 0.0575 Sales Tax = $1.61 How much would a $29.75 backpack cost with a sales tax of 8%? Sales Tax = $29.75 x 0.08 Sales Tax = $2.38 Total Cost = $29.75 + $2.38 Total Cost = $32.13 , Taxes Tips Worksheets - K12 Workbook Displaying all worksheets related to - Taxes Tips. Worksheets are Taxes tips and sales, Discount tax and tip, Tip and tax homework work, Discounts sales tax tips, Taxes tips and commission notes, Sales tax practice work, Name date practice tax tip and commission, Sales tax and discount work. *Click on Open button to open and print to worksheet. 1. turbotax.intuit.com › tax-tips › health-careAre Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos Jul 04, 2022 · America’s #1 tax preparation provider: As the leader in tax preparation, more federal returns are prepared with TurboTax than any other tax preparation provider. #1 online tax filing solution for self-employed: Based upon IRS Sole Proprietor data as of 2020, tax year 2019. Self-Employed defined as a return with a Schedule C/C-EZ tax form. › publications › p463Publication 463 (2021), Travel, Gift, and Car Expenses ... You spend $200 (including tax and tip) for a business meal. If $110 of that amount isn’t allowable because it is lavish and extravagant, the remaining $90 is subject to the 50% limit. Your deduction can’t be more than $45 (50% (0.50) × $90).

Discount Sales Tax Worksheets Teaching Resources | TpT Sales Tax, Tip, and Discount Color-By-Number Worksheet, by, Eugenia's Learning Tools, 4.7, (14) $3.00, PDF, This is a color by number worksheet focused on calculating total cost after after calculating sales tax, tip, or discount. The worksheet contains 12 problems. Answer Key provided.Great for basic independent practice or as a station activity. Sales Tax And Tip Worksheets - K12 Workbook Displaying all worksheets related to - Sales Tax And Tip. Worksheets are Tip and tax homework work, Taxes tips and sales, Name period date tax tip and discount word problems, Sales tax and discount work, Tax tip and discount word problems, Calculating sales tax, Markup discount and tax, Name date practice tax tip and commission. *Click on Open ... Instructions for Form 8027 (2021) | Internal Revenue Service Past year's information shown on lines 1 through 6 of Form 8027 as well as total carryout sales; total charge sales; percentage of sales for breakfast, lunch, and dinner; average dollar amount of a guest check; service charge, if any, added to the check; and the percentage of sales with a service charge. Type of clientele. Tax And Tip Worksheets - K12 Workbook Displaying all worksheets related to - Tax And Tip. Worksheets are Discount tax and tip, Tip and tax homework work, Taxes tips and sales, Sales tax and discount work, Tax and tip percent word problems, Name date practice tax tip and commission, Sales tax and discount work, Name period date tax tip and discount word problems.

› en › revenue-agencyCapital Gains – 2021 - Canada.ca For more information on tax shelters and gifting arrangements, see guide T4068, Guide for the Partnership Information Return (T5013 Forms). Allowable capital loss – This is, for a tax year, your capital loss for the year multiplied by the inclusion rate for that year. For 2001 and subsequent years, the inclusion rate is 1/2. Sales Tax And Tip Worksheet Create a sales and banknote receipts worksheet to ample out on a circadian base and absolute at the end of anniversary month. In this worksheet, actualize a amplitude to ascribe the absolute aliment sales, cooler sales, the sales tax calm on each, the tips answerable and added accordant receipts. › createJoin LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; Sales Tax And Discount Worksheets - K12 Workbook Displaying all worksheets related to - Sales Tax And Discount. Worksheets are Sales tax and discount work, Sales tax and discount work, Sales tax practice work, Discount tax and tip, Discount markup and sales tax, How to calculate discount and sales tax how much does that, Taxes tips and sales, Percent word problems tax tip discount.

eservices.dor.nc.gov › sau › sauhelp1020E-500, Sales and Use Tax Return - NC Under the column "Receipts," enter the amount of total taxable receipts, rentals, and sales subject to the 0.5% Transit County sales and use tax rate excluding the amount of tax collected. Line 12 - 0.25% Transit County Rate: As of October 1, 2020, no county has levied a 0.25% Transit County Tax.

2022 Individual Income Tax Forms - Marylandtaxes.gov Number Title Description; PV(2D) Income Tax Payment Voucher. Read PDF Viewer And/Or Browser Incompatibility if you cannot open this form.: Payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a Form 502 or Form 505, estimated tax payments, or extension payments.: PV

and Losses Capital Gains - IRS tax forms assets doesn’t apply to sales in tax years beginning after December 31, 2020. General Instructions Other Forms You May Have To File Use Form 461 to figure your excess business loss. Use Form 8949 to report the sale or exchange of a capital asset (defined lat-er) not reported on another form or schedule and to report the income defer-

Professional Services: QBI Deduction for Specified Services … Mar 03, 2020 · Search the Tax Pro Center Latest tax and accounting news and tips. Tax Law and News; Client Relationships; ... other than advice of counsel, such as sales, or the provision of training of educational courses. It also excludes consulting services embedded in, or ancillary to, the activities of a trade or business that isn’t an SSTB, if there ...

Sales Tax And Tip Teaching Resources | Teachers Pay Teachers Sales Tax, Tip, and Discount Task Cards, by, Live Love Math, 4.9, (232) $3.00, PDF, This is a set of 20 task cards to practice the concept of percents and real-world problems. The problems cover sales tax, discount, and tip and several problems include more than one step.

PDF Tip and Tax Homework Worksheet - Kyrene School District Name:&_____H our:&_____& & TipandTaxWorksheet& Findthepriceofthemealwiththegiveninformation.& & 1) Foodbillbeforetax:&$30& & & 2)&Foodbillbeforetax ...

Deductions | Virginia Tax Tip: The amount of employment-related expenses that may be subtracted is limited to the amount actually used in computing the federal credit for child and dependent care expenses. As a general rule, you are limited to a maximum of $3,000 for one child and $6,000 if you are claiming the expenses for two or more dependents, or the earned income ...

How to Value a Business: The Ultimate Guide - Fit Small Business Dec 18, 2019 · A popular method for valuing home prices, it is useful for businesses where a large amount of data on recent sales exists. It can be used in conjunction with one or more other methods to determine an accurate value. Market-based Key Data Points. Being able to compare sales prices is only the beginning.

1040NOW 1040Now Federal / State Tax Forms. Please contact 1040Now Support (cs@1040now.com) if you find any Federal or State Tax Forms missing from our list. Federal Tax Forms Federal Tax Forms Not Supported State Tax Forms; 1040 Forms Supported: 1040 - INDIVIDUAL TAX RETURN / SCHEDULE 1-3 1040-SR - U.S. TAX RETURN FOR SENIORS

floridarevenue.com › Forms_library › currentSales and Use Tax Returns - floridarevenue.com Effective July 1, 2021, the “Bracket System” for calculating sales tax and discretionary sales surtax is replaced by a rounding algorithm in Florida. For more information, see Tax Information Publication (TIP) 21A01-02. Certificate Number: Due: Late After: Reporting Period Surtax Rate: Florida 1. Gross Sales 2. Exempt Sales 3. Taxable ...

Florida Dept. of Revenue - Florida Dept. of Revenue Jun 27, 2022 · If you are contacted by someone representing themselves as an employee of the Florida Department of Revenue—whether it is by letter or form, a phone call or other communication—who appears unfamiliar with your specific tax or child support account information, please feel free to verify their identity by contacting the Department's Taxpayer ...

Sales Tax And Tip Worksheet - Abjectleader Estimate the tax on shoes that cost $68.50 when the sales tax rate is 8.25%. 7th Grade Tax And Tip Worksheets With Answers kidsworksheetfun from kidsworksheetfun.com There are mazes, a paper chain, and a set of task cards. 010 x 1500 150 the sale price is calculated as follows.

Sales Tax Worksheets - Math Worksheets 4 Kids Help them excel in sales tax using our free worksheets and prepare to face the world head-on! Finding Sales Tax, When you buy an item that is taxed, not only do you pay the cost of the item, you also pay the sales tax. Find the sales tax and calculate the total cost of the items using these 3-part printable worksheets! Finding the Original Price,

Sales Tax And Discounts Worksheets Teaching Resources | TpT Sales Tax, Tip, and Discount Color-By-Number Worksheet, by, Eugenia's Learning Tools, 4.7, (14) $2.50, PDF, This is a color by number worksheet focused on calculating total cost after after calculating sales tax, tip, or discount. The worksheet contains 12 problems. Answer Key provided.Great for basic independent practice or as a station activity.

DOC Sales Tax and Discount Worksheet - Chester Tax $ _____ Final cost _____ If your cell phone bill was $67.82 and there is a 7.5% late fee, how much will your bill be with the late fee included? If you go out to eat with 3 friends and your meal was $72.50, there is 6.75% sales tax and you should tip the waiter 15%. How much should each person pay? Tax $ _____

› minimum-wage-trackerMinimum Wage Tracker | Economic Policy Institute Jul 01, 2022 · The law applies to adult and minor employees who work two or more hours per week for a business that is subject to the Belmont Business License Tax OR that maintains a facility in Belmont. $16.20: $15.90 to $16.20, effective 1-1-2022: Annual indexing effective January 1: Belmont enacted its own minimum wage in 2017 by city council ordinance.

PDF Taxes, Tips, and Sales - McNabbs $62.30 , 6) A restaurant requires customers to pay a 15% tip for the server. Your family spends $45 on the meal. , How much money do you need to pay the server? , $6.75 , b) How much money will you spend total? , $51.75 , 7) A store has a sale for 20 % off. You decide to buy a $15 t-shirt. , How much money will you save? , $3.00 ,

PDF Sales Tax and Discount Worksheet - Loudoun County Public Schools MORE COMPLICATED QUESTIONS!!! , 8) At best buy they have a 42" TV that sells for $1250 and is on sale for 15% and sales tax is 6.5%. What is the final cost? , 9) If your cell phone bill was $67.82 and there was a 7.5% late fee, how much was the charge for the cell phone bill? ,

SALES TAX DISCOUNT AND TIP WORKSHEET - onlinemath4all Estimate the tax on shoes that cost $68.50 when the sales tax rate is 8.25%. Problem 3 : The dinner check for Mr. David's family is $70. If a tip of 15% is paid, How much total money should Mr. David pay ? Problem 4 : If the sales tax rate is 6%, find price of the shirt after sales tax on a shirt that costs $30. Problem 5 :

PDF Tax and Tip (Percent) Word Problems - hansenmath.com 1. A bicycle is on sale for $189.50. The sales tax rate is 5%. What is the total price? 2. Rosa and her friends are eating out for dinner. The bill was $45.80. They want to leave a 20% tip. How much should they leave for tip? 3. Rick bought 3 shirts for $18 each, 2 pair of socks for $3.99 a pair, and a pair of slacks for $45.00.

0 Response to "41 sales tax and tip worksheet"

Post a Comment