39 How To Solve Sales Tax

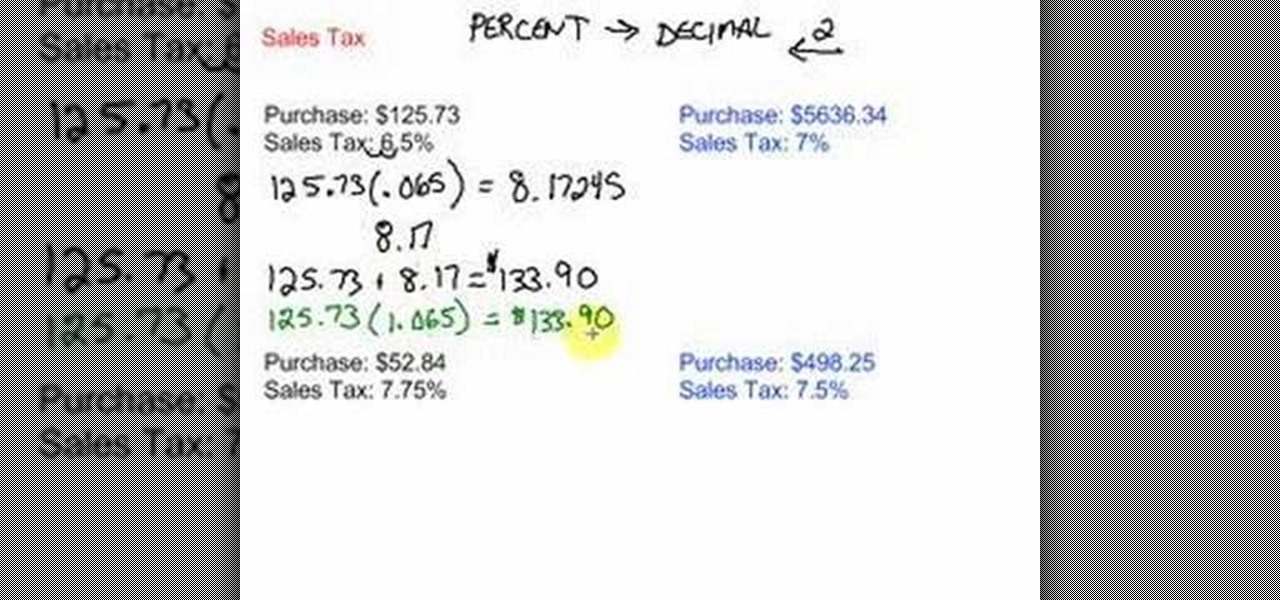

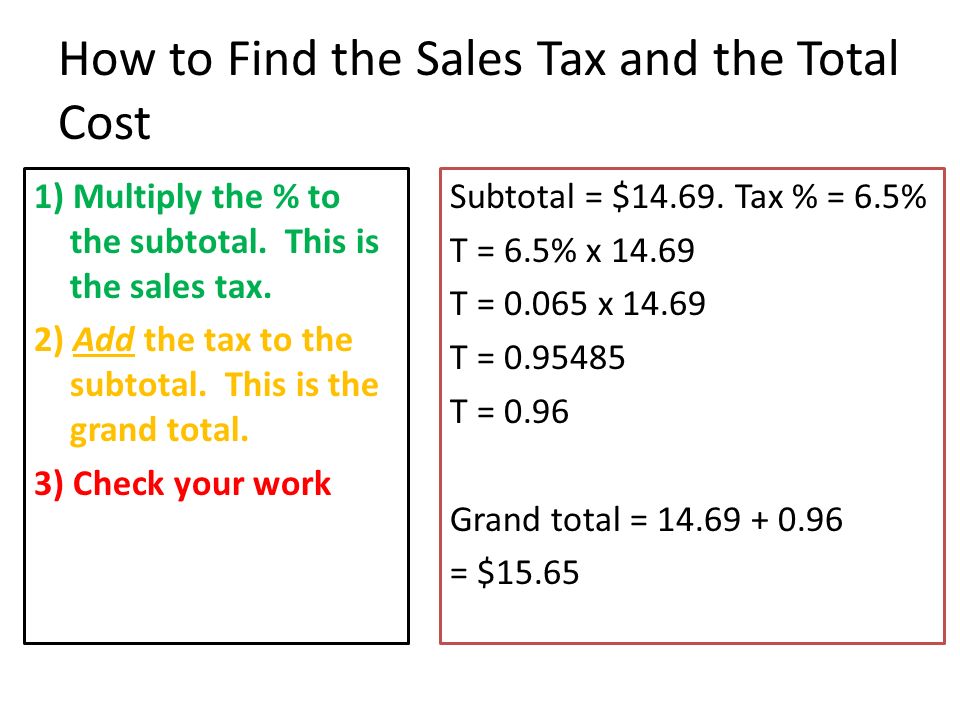

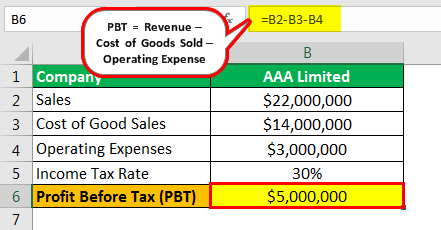

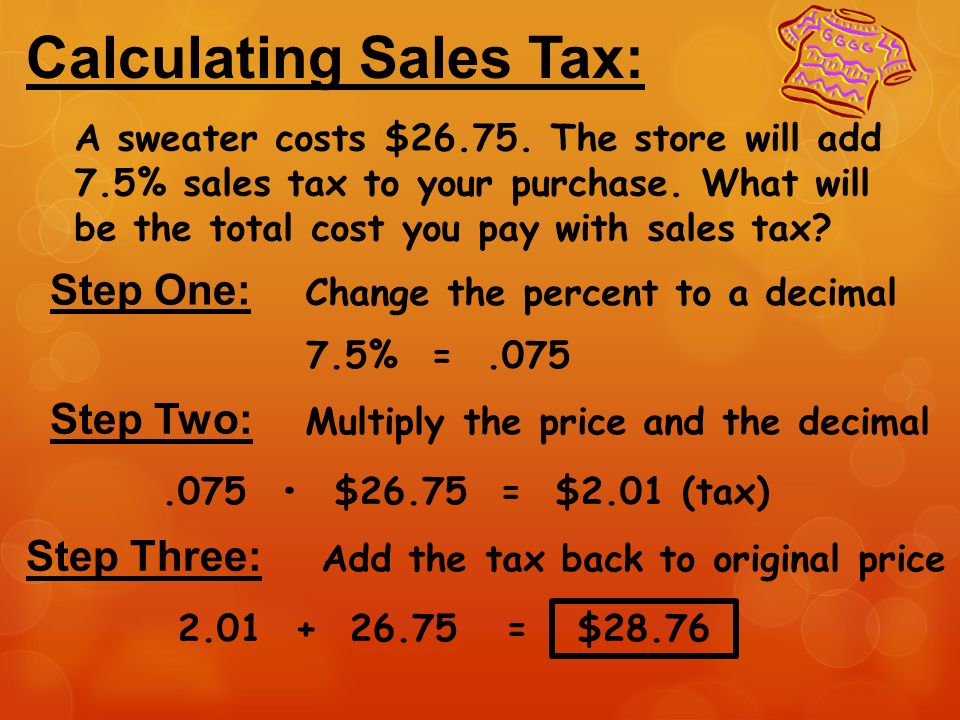

How Businesses Calculate Sales Tax (With Examples ... The sales tax formula is: [Total taxable sales price] x [Sales tax rate in decimal form] = Sales tax amount. After you find the sales tax amount, add it to the total taxable and non-taxable sales price to calculate the final sales amount. Be sure to add the total non-taxable sales price back in at this point. How to Calculate Sales Tax - TaxJar How do you calculate sales tax? Determine the cost of the item you are purchasing. Determine the sales tax rate at the point of sale. The point of sale is wherever you are taking possession of the item. If you are ordering it online, the point of sale is the address where you are having the item shipped.

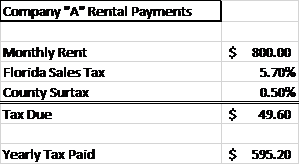

Louisiana Sales Tax Calculator - SalesTaxHandbook Louisiana has a 4.45% statewide sales tax rate, but also has 262 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 5.084% on top of the state tax. This means that, depending on your location within Louisiana, the total tax you pay can be significantly higher than the 4.45% state sales tax.

How to solve sales tax

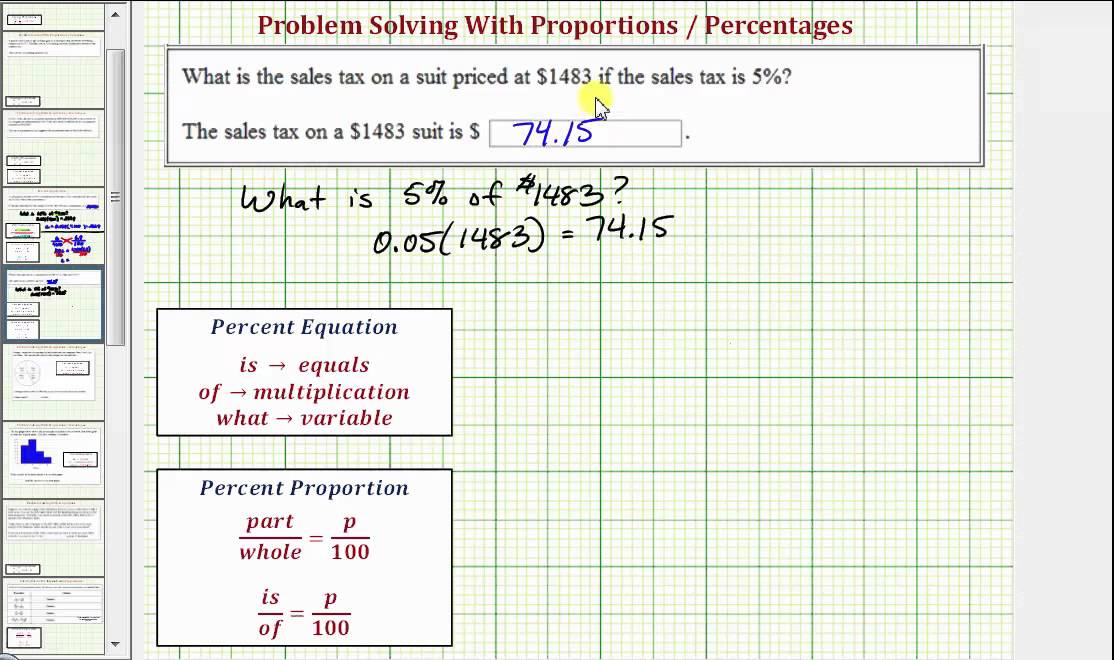

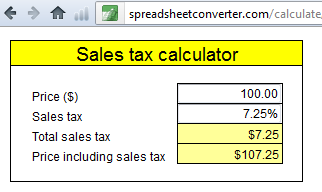

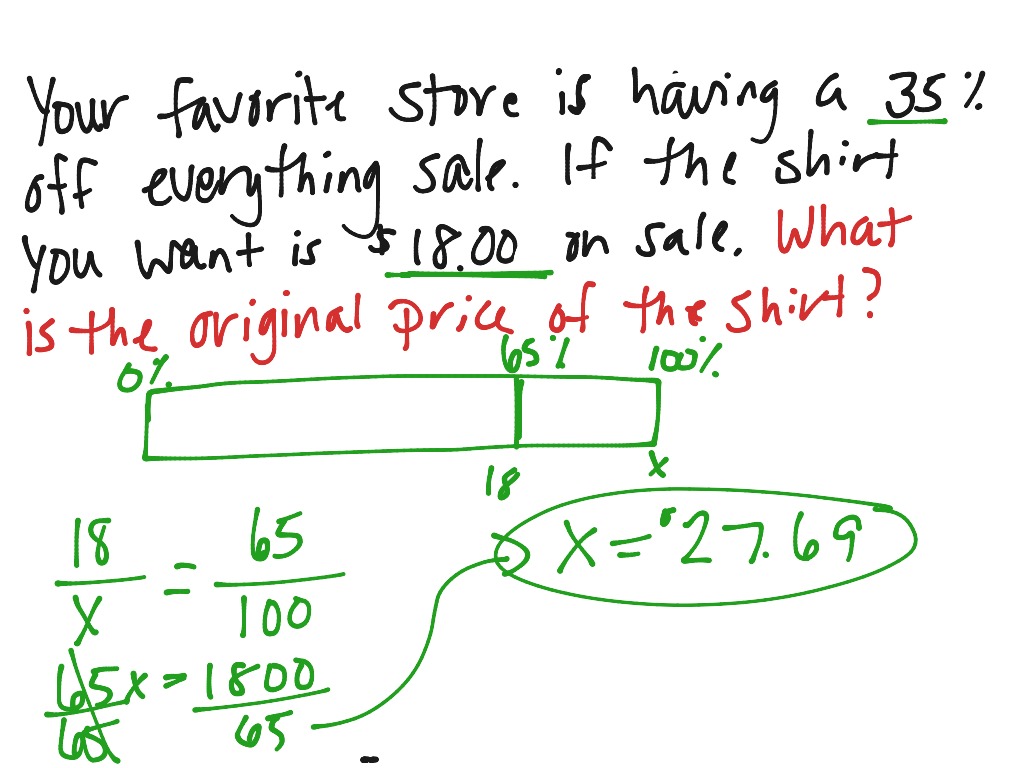

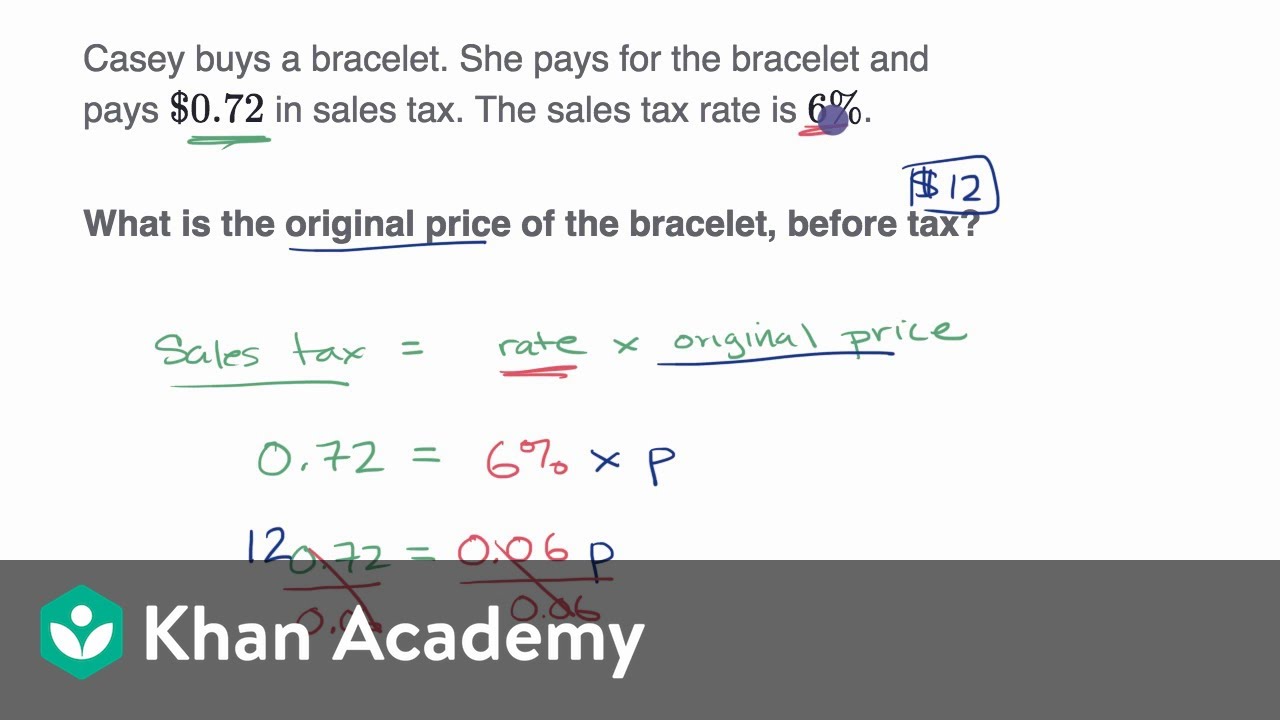

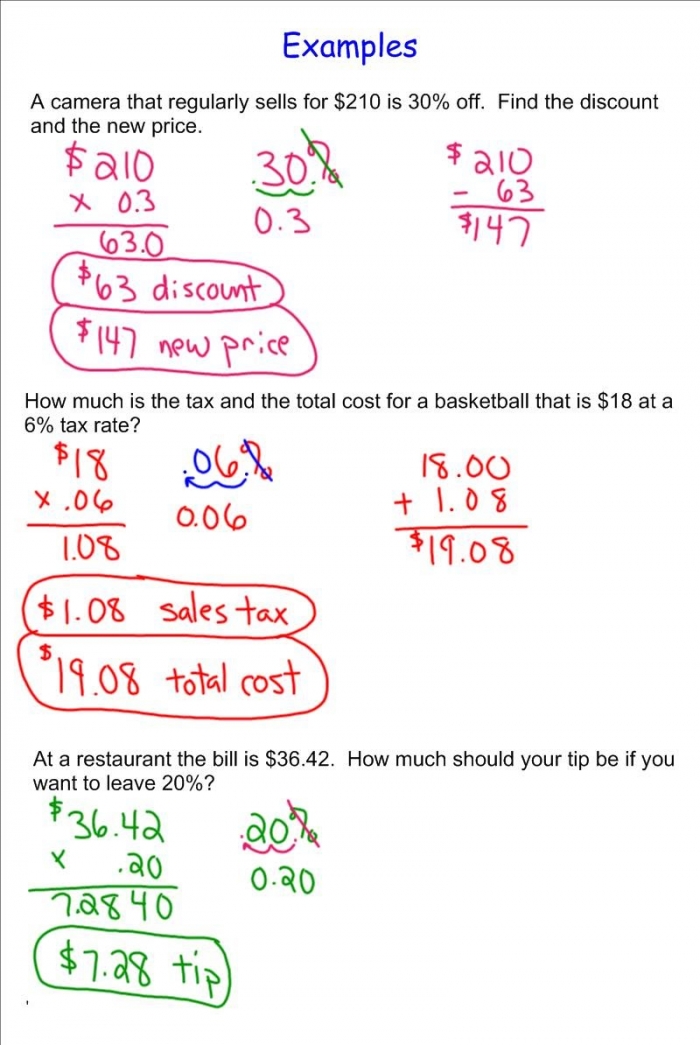

How to solve sales tax math problems - Quora The best way to solve this is using proportions with cross multiplication. So basically you say that 1000 is equal to 110% of the total cost. Then you say that the variable "X" is equal to 100 percent. You set up a proportion using this information. 1000/x=110/100. Then you use cross multiplication multiplying 1000*100 and x*110. Sales Tax Calculator and Rate Lookup 2021 - Wise Download sales tax lookup tool→ Once you know the local sales tax rate for your area you can use the sales tax formula below to figure out how much to charge your customers on each sale. Sales tax = total value of sale x sales tax rate. Or make life even easier by using the handy calculator at the top of the page to get the sales tax detail ... New York City Sales Tax Rate and Calculator 2021 - Wise Sales tax = total amount of sale x sales tax rate (in this case 8%). Or to make things even easier, input the NYC minimum combined sales tax rate into the calculator at the top of the page, along with the total sale amount, to get all the detail you need. Wise is the cheaper, faster way to send money abroad.

How to solve sales tax. How To Calculate Tax From Total Amount and Similar ... To calculate the sales tax that is included in receipts from items subject to sales tax, divide the receipts by 1 + the sales tax rate. For example, if the sales tax rate is 6%, divide the total amount of receipts by 1.06. $255 divided by 1.06 (6% sales tax) = 240.57 (rounded up 14.43 = tax amount to report. How to Calculate Sales Tax | Math with Mr. J - YouTube Welcome to How to Calculate Sales Tax with Mr. J! Need help with calculating sales tax and total cost? You're in the right place!Whether you're just starting... Sales Tax Calculator A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Usually, the vendor collects the sales tax from the consumer as the consumer makes a purchase. In most countries, the sales tax is called value-added tax (VAT) or goods and services tax (GST), which is a different form of consumption tax. In some countries, the listed prices for goods and services are the before-tax value, and a sales tax is only applied during the purchase. In other countries, the listed prices are the final after-tax values, which include the sales tax. Sales Tax Deduction: How It Works, What to Deduct - NerdWallet There are two ways to calculate your sales tax deduction: Pull your hair out trying to find receipts for everything you bought during the year, so you can add up the sales tax, or Just estimate...

Sales Tax Calculator - Convert It Calculate the amount of sales tax and total purchase amount given the price of an item and the sales tax rate percentage. How To Calculate Sales Tax: Formula To Use With an Example ... Sales tax applies to most consumer product purchases and exists in most states. The sales tax formula is simply the sales tax percentage multiplied by the price of the item. It's important for businesses to know how to use the sales tax formula so that they can charge their customers the proper amount to cover the tax. How to Calculate Sales Tax: Complete Guide | BooksTime To find an amount of sales tax, you would just multiply the cost of a particular item by a sales tax rate in a decimal format. Then, you can find out the total price that you usually see on receipts by adding the sales tax amount to the cost of the item you are buying. Sales Tax Calculator - Find Inclusive or Exclusive Tax Access our sales tax calculator by clicking on . Select tax type between the inclusive or exclusive tax option. Enter your amount in the given box for sales tax calculation. Set the sales tax percentage as per the law of your country. Accurate results will be displayed within a blink of an eye.

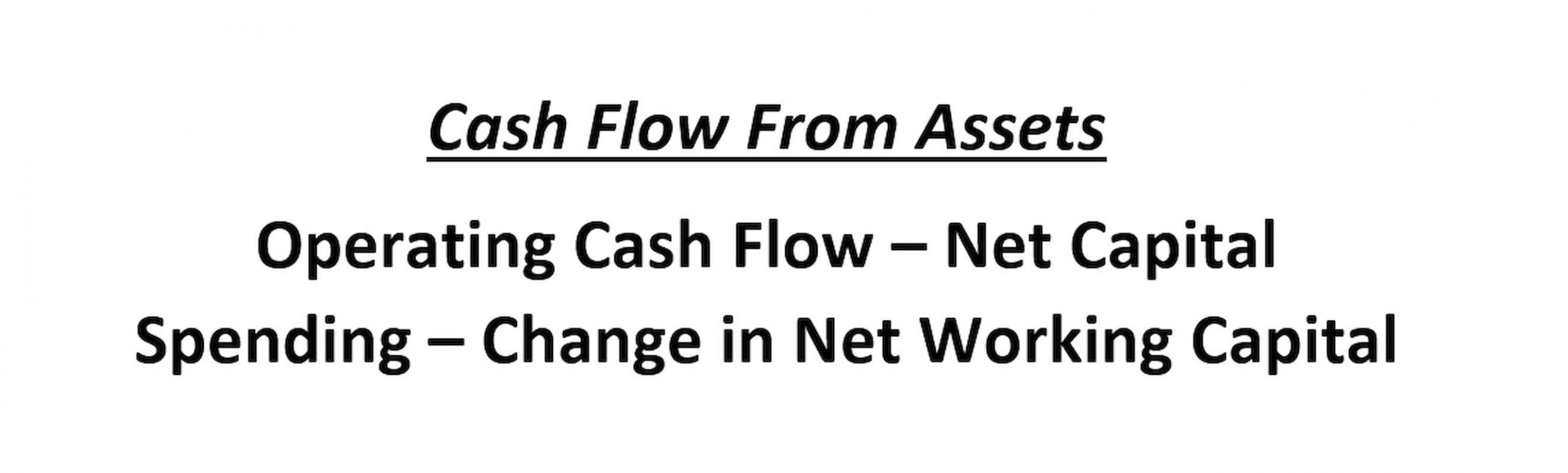

How to Calculate Sales Tax | Definition, Formula, & Example Use the following formula to calculate sales tax: To determine how much sales tax to charge, multiply your customer's total bill by the sales tax rate. Example Let's say your business is located in Cleveland, Ohio. You don't have a secondary business location. How to Calculate, Complete, and File Your October Sales Tax Check out TaxJar's website if you need help determining just how much sales tax you collected and filling out your sales tax returns. File your sales tax returns. Once you've figured out all the hard stuff — how much sales tax you collected and where you collected it — then it's time to file your sales tax return. You have a few options here: How to solve sales tax problems, how to solve problems at ... Sales tax resource group specializes in solving multistate sales & use tax problems including sales tax audit defense services and credit & refund studies. Problem: a local accountant in your suburb has requested you to develop a. How To Calculate Tax Free Price? - AnswerHints How to calculate sales tax on a receipt? To calculate the sales tax that is included in a company's receipts, divide the total amount received (for the items that are subject to sales tax) by "1 + the sales tax rate". In other words, if the sales tax rate is 6%, divide the sales taxable receipts by 1.06.

How do I calculate the amount of sales tax that is ... Sales Tax Calculation To calculate the sales tax that is included in a company's receipts, divide the total amount received (for the items that are subject to sales tax) by "1 + the sales tax rate". In other words, if the sales tax rate is 6%, divide the sales taxable receipts by 1.06.

How to Calculate Sales Tax on a Car - Mozbox English The amount of sales tax you pay when buying a car depends on where you live. You need to know the local rules about whether a trade-in counts towards a down payment or lowers your purchase price. If you buy a car from a dealership out of state, the dealership uses your state's tax rate to calculate the sales tax and then sends it to your jurisdiction.

How To Calculate Sales Tax? - Insurance Noon The sales tax formula is: Total item price x 1 + sales tax rate = total sales tax. For instance, suppose you are purchasing an item evaluated at $10.00 and the sales tax rate is 6%. $10 total item price x 1.06 = $10.60. Sales tax rates can change from one state to another and even inside areas or urban communities.

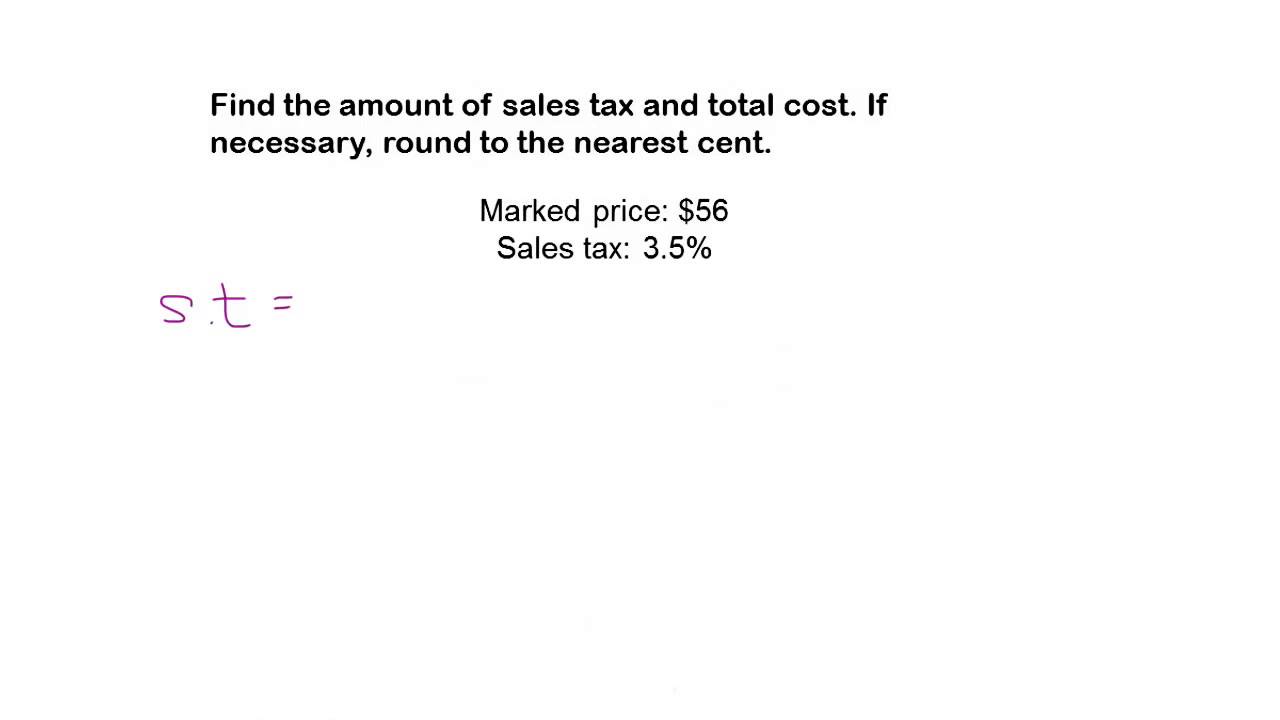

Solving Problems involving Sales Tax, Commission, Discount ... Solving Problems involving Sales Tax, Commission, Discount and Interest Sales Tax: Sales TaxSales TaxSales Tax = Sales tax rate (as a decimal) × Purchase price Total price = Purchase price + sales taxTotal price Examples: Solve the following problems. 1. How much sales tax is charged on an item that costs $250 if the sales tax rate is 6%?

How do I calculate tax from a total? - Big Photography ... To calculate the sales tax that is included in a company's receipts, divide the total amount received (for the items that are subject to sales tax) by "1 + the sales tax rate". In other words, if the sales tax rate is 6%, divide the sales taxable receipts by 1.06. In the same way How do I add 5.5 tax? Divide the tax rate by 100.

How to Calculate Used Car Sales Tax | DMV.ORG While tax rates vary by location, the auto sales tax rate typically ranges anywhere from two to six percent. Multiply the net price of your vehicle by the sales tax percentage. Remember to convert the sales tax percentage to decimal format. For example, if your state sales tax rate is 4%, you would multiply your net purchase price by 0.04.

Use the Sales Tax Deduction Calculator | Internal Revenue ... The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms 1040 or 1040-SR). Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 ($5,000 if married filing separately).

Sales Tax: Definition, How It Works, How To Calculate It ... Sales taxes apply to the sale of goods and services and are a percentage of the total purchase amount. Retailers are responsible for calculating and collecting sales tax at the time a purchase is ...

How to Calculate Sales Tax - AccurateTax.com Jan 19, 2022 · Formula: Item Price x Sales Tax Rate = Total Sales Tax. $50 x 0.06 = $3. Total Sales Tax + Item Price = Final Amount Paid. $3 + $50 = $53. This formula is automatically applied to almost every purchase made, with some exceptions depending on state and municipality. Let’s take a closer look at these other factors and how to calculate sales tax ...

4 Ways to Calculate Sales Tax - wikiHow To calculate the sales tax that is included in receipts from items subject to sales tax, divide the receipts by 1 + the sales tax rate. For example, if the sales tax rate is 6%, divide the total amount of receipts by 1.06. $255 divided by 1.06 (6% sales tax) = 240.57 (rounded up 14.43 = tax amount to report. Thanks! Yes No Not Helpful 45 Helpful 62

How To Solve Sales Tax Problems? (TOP 5 Tips) Dec 20, 2021 · How To Solve Sales Tax Problems? (TOP 5 Tips) The sales tax is determined by computing a percent of the purchase price. To find the sales tax multiply the purchase price by the sales tax rate. Remember to convert the sales tax rate from a percent to a decimal number. Once the sales tax is calculated, it is added to the purchase price.

New York City Sales Tax Rate and Calculator 2021 - Wise Sales tax = total amount of sale x sales tax rate (in this case 8%). Or to make things even easier, input the NYC minimum combined sales tax rate into the calculator at the top of the page, along with the total sale amount, to get all the detail you need. Wise is the cheaper, faster way to send money abroad.

Sales Tax Calculator and Rate Lookup 2021 - Wise Download sales tax lookup tool→ Once you know the local sales tax rate for your area you can use the sales tax formula below to figure out how much to charge your customers on each sale. Sales tax = total value of sale x sales tax rate. Or make life even easier by using the handy calculator at the top of the page to get the sales tax detail ...

How to solve sales tax math problems - Quora The best way to solve this is using proportions with cross multiplication. So basically you say that 1000 is equal to 110% of the total cost. Then you say that the variable "X" is equal to 100 percent. You set up a proportion using this information. 1000/x=110/100. Then you use cross multiplication multiplying 1000*100 and x*110.

0 Response to "39 How To Solve Sales Tax"

Post a Comment